Basel I: A Key Overview Of Banking Regulations & Impact

Have you ever wondered how the world's banking system maintains a semblance of order and stability? The answer, in part, lies in a series of international agreements known as the Basel Accords, and it all began with Basel I.

Basel I, the inaugural accord, represents a pivotal moment in the history of international finance. Conceived in the late 1970s and 1980s, and officially published in 1988 by the Basel Committee on Banking Supervision (BCBS) in Basel, Switzerland, it sought to establish a global standard for bank capital adequacy. This wasn't just about numbers; it was about creating a more resilient and interconnected financial system, one that could better withstand economic shocks and minimize the risk of widespread bank failures. Basel I was a response to the increasing globalization of financial markets and the need for a common set of rules to ensure fair competition and stability.

| Aspect | Details |

|---|---|

| Name | Basel I (Basel Capital Accord) |

| Year Introduced | July 1988 |

| Origin | Basel Committee on Banking Supervision (BCBS), Basel, Switzerland |

| Objective | Establish minimum capital requirements for banks to mitigate credit risk. |

| Key Feature | Risk-weighted assets; banks must hold capital equal to at least 8% of their risk-weighted assets. |

| Focus | Primarily credit risk. |

| Successors | Basel II, Basel III |

| Further Information | Bank for International Settlements (BIS) Website |

The core principle of Basel I revolved around capital adequacy. It mandated that banks hold capital equivalent to at least 8% of their risk-weighted assets. This seemingly simple requirement had profound implications. It forced banks to carefully assess the risks associated with their lending activities and to allocate capital accordingly. Assets were categorized into different risk buckets, ranging from 0% for the safest assets (like cash and government bonds) to 100% for the riskiest (such as corporate loans). This risk-weighting system was a crucial innovation, as it recognized that not all assets are created equal in terms of risk.

- Hd Hub 4u Your Guide To Streaming Movies Tv Shows Online

- Best Ullu Web Series Find Top Shows Watch Online Year

To understand the impact of Basel I, it's important to delve into the context of its creation. The 1970s and 1980s were a period of significant change in the global financial landscape. Deregulation, technological advancements, and increased cross-border capital flows were transforming the banking industry. However, this rapid growth also brought new risks. The lack of a consistent regulatory framework made it difficult to compare the financial health of banks across different countries, and it created opportunities for regulatory arbitrage, where banks could exploit loopholes in national regulations to take on excessive risk. Basel I was designed to address these challenges and to create a level playing field for international banks.

The Basel Committee on Banking Supervision (BCBS) played a central role in the development and implementation of Basel I. The BCBS is a committee of banking supervisory authorities that was established in 1974 by the central bank governors of the Group of Ten (G10) countries. Its mandate is to strengthen the regulation, supervision, and practices of banks worldwide and to enhance financial stability. The BCBS has no formal legal authority, but its recommendations carry significant weight, as its members are committed to implementing them in their respective jurisdictions. The committee's deliberations are informed by a deep understanding of the banking industry and a commitment to evidence-based policymaking.

The implementation of Basel I was a gradual process, as national governments had to incorporate its recommendations into their own laws and regulations. This transformation into national law was crucial for ensuring that the accord had teeth. While Basel I itself was a set of recommendations, its adoption by individual countries made it a binding legal obligation for banks operating within those jurisdictions. This process of national implementation underscored the importance of international cooperation in financial regulation. It demonstrated that countries could work together to create a more stable and resilient global financial system.

- Vegamovies Netflix Your Guide To Hindi Dubbed Movies 2024

- Movierulz 2024 Is Telugu Movie Download Safe Legal Options

Basel I primarily addressed credit risk, which is the risk that a borrower will default on a loan. By requiring banks to hold capital against their credit exposures, Basel I aimed to reduce the likelihood of bank failures due to loan losses. The accord achieved this by standardizing the way banks measure and manage credit risk. It provided a clear framework for assessing the riskiness of different assets and for allocating capital accordingly. This standardization made it easier for supervisors to compare the financial health of banks and to identify potential problems early on.

However, Basel I was not without its limitations. One of the main criticisms was its focus on credit risk to the exclusion of other important risks, such as market risk and operational risk. Market risk refers to the risk of losses due to changes in market prices, such as interest rates, exchange rates, and equity prices. Operational risk, on the other hand, refers to the risk of losses due to inadequate or failed internal processes, people, and systems, or external events. Basel I's limited scope meant that banks could still take on excessive risk in these other areas, potentially undermining the overall stability of the financial system. This oversight led to calls for a more comprehensive approach to banking regulation.

Another criticism of Basel I was its reliance on a relatively simple risk-weighting system. The accord assigned assets to only a few broad risk categories, which did not always accurately reflect the true level of risk. For example, all corporate loans were assigned the same risk weight, regardless of the borrower's creditworthiness. This could lead to banks underestimating the riskiness of some loans and overestimating the riskiness of others. The simplicity of the risk-weighting system also created opportunities for regulatory arbitrage, as banks could structure their assets in ways that minimized their capital requirements without necessarily reducing their overall risk. The need for a more nuanced and risk-sensitive approach became increasingly apparent.

Despite its limitations, Basel I had a significant impact on the banking sector. It led to a substantial increase in bank capital levels worldwide, making banks more resilient to economic shocks. It also promoted greater consistency in banking regulation across different countries, reducing the scope for regulatory arbitrage. Basel I laid the foundation for subsequent accords, such as Basel II and Basel III, which built upon its principles and addressed its shortcomings. It marked a turning point in the history of international financial regulation, ushering in an era of greater cooperation and coordination among banking supervisors.

The Basel framework, as a whole, represents the full set of standards established by the BCBS. These standards are constantly evolving to keep pace with changes in the financial landscape. The membership of the BCBS has agreed to fully implement these standards and apply them to the internationally active banks in their jurisdictions. This commitment to implementation is essential for ensuring that the Basel framework remains effective in promoting financial stability. The framework is designed to be flexible enough to accommodate the diverse needs of different countries, while still providing a consistent set of principles for banking regulation.

The Basel Accords, including Basel I, are not directly enforceable laws. Instead, they are recommendations that national governments are expected to implement through their own legal and regulatory frameworks. This process of national implementation is crucial for ensuring that the accords have a real impact on the ground. It requires national authorities to adapt the Basel standards to their own specific circumstances, while still maintaining the core principles of the accords. This can be a challenging task, as it requires balancing the need for international consistency with the need for national flexibility.

The Basel norms are an effort to coordinate banking regulations across the globe, with the goal of strengthening the international banking system. This coordination is essential for preventing regulatory arbitrage and for ensuring that banks are subject to consistent standards, regardless of where they operate. The Basel norms have played a key role in promoting financial stability over the past few decades. They have helped to reduce the likelihood of bank failures and to mitigate the impact of financial crises.

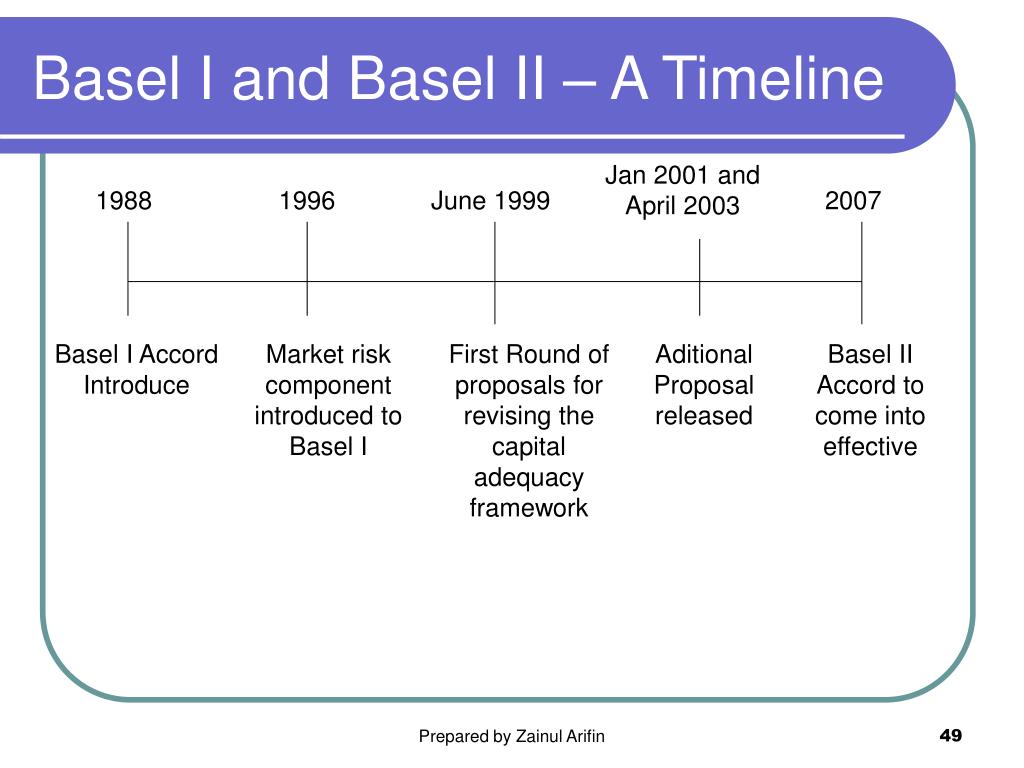

Till date, the BCBS has released three Basel Accords: Basel I, Basel II, and Basel III. Each accord has built upon its predecessor, addressing its shortcomings and adapting to changes in the financial landscape. Basel II, for example, introduced a more risk-sensitive approach to capital adequacy, while Basel III focused on strengthening bank liquidity and reducing systemic risk. These accords represent a continuous effort to improve the regulation and supervision of banks and to enhance the stability of the global financial system.

Currently, Basel III is under implementation by various members, including India. The implementation of Basel III is a complex and challenging task, as it requires significant changes to banking regulations and practices. However, it is essential for ensuring that banks are adequately capitalized and liquid and that they are able to withstand future economic shocks. The successful implementation of Basel III will contribute to a more resilient and stable global financial system.

The evolution from Basel I to Basel III reflects a growing understanding of the complexities of the banking industry and the need for a more comprehensive and risk-sensitive approach to regulation. Basel I was a crucial first step, but it was recognized that it needed to be refined and expanded to address the full range of risks facing banks. Basel II and Basel III have built upon the foundation laid by Basel I, creating a more sophisticated and effective framework for banking regulation. This evolution is a testament to the ongoing commitment of the BCBS and its member countries to promoting financial stability.

The significance of Basel I lies in its role as the first international standard in banking supervision. It established a common framework for measuring and managing capital adequacy, which helped to level the playing field for banks across different countries. It also promoted greater transparency and accountability in the banking sector. Basel I set the stage for subsequent accords, which have further strengthened the regulation and supervision of banks. Its legacy continues to shape the global financial system today.

Understanding Basel I requires an appreciation of its historical context, its core principles, and its limitations. It is important to recognize that Basel I was a product of its time, and that it has been superseded by more comprehensive accords. However, it remains a significant milestone in the history of international financial regulation. It demonstrated that countries can work together to create a more stable and resilient global financial system. Its principles continue to inform the regulation and supervision of banks around the world.

Basel I established international banking regulations to mitigate credit risk. The Basel I capital accord was created in 1988 to strengthen the stability of the international banking system and decrease competitive inequality. In 1988, BCBS introduced the first international standards, Basel I, to manage banking risk with the help of a standardized capital adequacy ratio. CRAR ensures minimum capital to cover depositors money from risky assets. Basel I categorizes bank assets into different risk levels, assigning weights of 0%, 20%, 50%, or 100% based on credit risk, influencing capital requirements. This structure simplifies risk assessment but has faced criticism for its broad categorization.

An assessment of compliance with Basel norms was recently conducted by the regulatory body, demonstrating the ongoing importance of these standards. This comprehensive course on Basel norms provides a deep understanding of banking regulations and their historical context. Discover the benefits and limitations of Basel I before progressing to the addition of market risk in later accords. The Basel Accord is an international standard in banking supervision, serving as an agreement between supervisors that leads to the creation of regulations within jurisdictions. The BIS checks compliance of authorities with the standard.

- Vegamovies Netflix Your Guide To Hindi Dubbed Movies 2024

- Vegamovies 3 Key Features Why Its A Top Streaming Choice

PPT The Basel I and Basel II Accords PowerPoint Presentation, free

Introduction to Basel 2 and Basel 1 Vs. Basel 2 YouTube

:max_bytes(150000):strip_icc()/BaselIIAccordGuardsAgainstFinancialShocks1-fb23a015d23643009e189c8f43c74a03.png)

Basel Accords Guard Against Financial Shocks